This spring, the Securities and Exchange Commission (SEC) opened for comment a review of its Regulation S-K filing—inviting comment on both form and substance of disclosures for companies listed on U.S. stock exchanges. Among many other matters, the SEC consultation document sought comment on whether disclosure on sustainability and other matters related to social policy should be mandated.

This is an interesting development, especially given the European Union Directive 2014/95, which mandates—for companies operating in its member states—disclosure of sustainability and diversity information. The Directive is set to go into effect in December of this year and affects any company or organization operating in an EU member state with the following attributes:

This spring, the Securities and Exchange Commission (SEC) opened for comment a review of its Regulation S-K filing—inviting comment on both form and substance of disclosures for companies listed on U.S. stock exchanges. Among many other matters, the SEC consultation document sought comment on whether disclosure on sustainability and other matters related to social policy should be mandated.

This is an interesting development, especially given the European Union Directive 2014/95, which mandates—for companies operating in its member states—disclosure of sustainability and diversity information. The Directive is set to go into effect in December of this year and affects any company or organization operating in an EU member state with the following attributes:

- Employs more than 500 people;

- Falls into “public-interest” organizations, which are defined to include EU exchange-listed companies as well as some unlisted companies, such as credit institutions, insurance companies, and other businesses selected by Member States (based on size, number of employees, and/or activities)

- Have a balance sheet total of at least EUR$20 million (approximately USD$25 million) or a net turnover of at least EUR$40 million (approximately USD$50 million).

This is a positive step forward toward a sustainable economy and one that has support among business leaders and investors alike. In the Center for Corporate Citizenship’s 2014 State of Corporate Citizenship study, the majority of executives reported that environmental, social, and governance (ESG) efforts deliver value to shareholders over the short, medium, and long terms.

A recent EY survey of 200 institutional investors underscores investor concern with corporate environmental, social, and governance (ESG) performance and disclosure. Among the findings in their report, Investment Rules 2.0: nonfinancial and ESG reporting trends:

- The percentage of respondents who consider mandatory board oversight of nonfinancial performance reporting “essential” or “important” increased from 36 percent in 2014 to 80 percent this year.

- Investors are increasingly enthusiastic about the benefits of integrated reports, with a vast majority indicating they are “essential” or “important” in this year’s study.

- Investors are facing a deficit of the quality and type of nonfinancial information they want. Nearly two-thirds of respondents indicate that issuers are not adequately disclosing ESG risks.

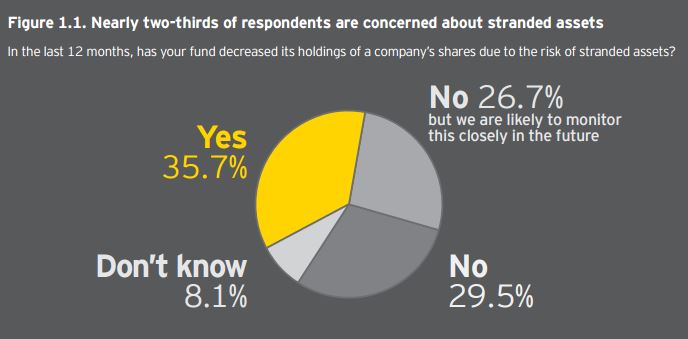

- Concerns over the potential impacts of stranded assets due to ESG risks are on the rise. The study shows that more than one-third of respondents actually took steps to cut holdings due to stranded asset risk in the past year (see Figure 1.1).

Image source: EY. (2016). Investment Rules 2.0: nonfinancial and ESG reporting trends.

Investors are paying closer attention to corporate citizenship and ESG disclosure because strong performance illustrates that a company both recognizes and manages its responsibilities prudently, understands its impacts and works to mitigate them, stays abreast of trends and emerging regulations, and works to engage with and understand its stakeholders—leading to happier employees, communities, and customers. Investors understand that disclosure about and good management of sustainability and social issues are indicators of a company that limits waste, lowers risk, and makes the most efficient use of human capital.

Take a look at your corporate citizenship programs. Are they part of a cohesive strategy to improve your operating environment? Do they help your company meet its business goals? Do they make use of your employees’ skills and passions? Are you measuring and evaluating your impacts and achievements? Now, take a look at your communications strategy. Are you taking the necessary steps to communicate to investors and other relevant stakeholders what you are doing with your ESG investments and why? Doing so takes some work on the front end, but pays off in the long run—literally.

Learn what your investors care about. You can learn more about their areas of focus by reading your company’s annual reports and either attending or listening to your shareholder meetings. Partner internally with investor relations and finance teams and arm them with relevant information. Gather metrics and make use of a reporting framework to disclose corporate citizenship information in a complete and consistent manner that allows investors to more easily assess your risks, impacts, and efforts.

The disclosure of material sustainability information strengthens competitiveness and ensures sustainable prosperity, not only for this quarter and this year, but for generations to come. Disclosing and managing the sustainability and public policy issues most likely to have financial impacts helps companies mitigate risk and identify opportunities for sustainable growth.

You may be asking yourself where to begin. There are many options from which to select when you are considering your disclosure format. Many companies are disclosing on climate and other sustainability risk in the SK forms already. Most Boston College Center for Corporate Citizenship members are U.S. companies operating globally. While the EU Directive 2014/95 does not introduce a requirement on the reporting framework that should be used to report, companies are encouraged and expected to rely on one of the internationally recognized instruments such as the Global Reporting Initiative (GRI) Framework, the United Nations Global Compact (UNGC) Principles, the UN Guiding Principles on Business and Human Rights, the OECD Guidelines for Multinational Enterprises, ISO 260009, the International Labour Organization (ILO) Tripartite declaration of principles concerning multinational enterprises and social policy, and the European Eco-Management and Audit Scheme (EMAS).

We support harmonization with the EU Directive as we see that it will achieve the objectives of making disclosures more comparable and efficient as companies disclose information in multiple contexts and formats.

Most importantly, we should not forget the purpose of reporting, which is to track performance (improvements) on issues that are important to business and society. Essentially, corporate citizenship is a cycle. By benefiting our society we strengthen the business, which allows us to further benefit society. It’s a cycle powered best by strong balance sheets. The good news is that investors are recognizing your contributions to the success of the business.

To learn more about how you can make use of reporting platforms to meet your goals, check out the Center’s GRI G/4 course, the Corporate Citizenship Frameworks course, and the CDP Reporting course. As a certified training partner for GRI, CDP, and IIRC’s <IR> Training Programme, the Center can help you understand and utilize leading sustainability frameworks to drive both social and environmental progress—and business results.