UPDATED: April 9, 2025

Originally published in Carroll Capital, the print publication of the Carroll School of Management at Boston College. Read the full issue here.

In 2009, Tom Coburn ’13 was a freshman in Shaw House, studying

biology and theology with an eye toward medical school. His roommates were excited about what was then called BC VC, a venture capital competition offered through the Carroll School of Management, and they convinced Coburn to participate with them in the competition. Their idea, for a medical device company, didn’t win, but Coburn was bitten by the entrepreneurial bug.

.jpg)

Tom Coburn '13

He continued to brainstorm ideas, and one day at Logan Airport, as he stared up at the television screens in the terminal, Coburn realized that he was ignoring the ads. “I started wondering, ‘What if we could attach questions to ads to make sure you were paying attention? And then pay people for getting the answers right, and only charge the businesses if you got the answer right,’” says Coburn.

The next year, he entered the BC VC with the idea for that business, called Jebbit, and tied for first place. One of the judges was Peter Bell ’86, P ’20, ’25, who told him about a summer accelerator program for college startups at Highland Capital Partners, where Bell worked at the time. “That program changed the trajectory of my life,” says Coburn. He dropped his plan for medical school and ran with Jebbit, which today employs 100 people and works with premier brands like the NFL and L’Oreal.

Then he came up with another idea. “I went to Peter and said, ‘Why don’t we do a summer accelerator just for BC students?’” Together with Miguel Galvez, MCAS ’12, they launched SSC Venture Partners as a nonprofit accelerator program for that purpose. Ten years later, SSC has become a fixture of Boston College’s entrepreneurial community, which revolves around the Edmund H. Shea Jr. Center for Entrepreneurship and its daily programming. More recently, SSC added venture capital to its offerings, pivoting to for-profit status. It also opened up its accelerator to Boston College alumni and staff.

SSC’s general partners (GPs) take no salary but participate in funding decisions and mentorship and receive a portion of fund earning. They "care deeply about BC and paying it forward to younger generations of people within the BC community,” says Christina Quinn ’13, one of the GPs and a founder of Lua, an early-stage startup consultancy. “It’s very reflective of the broader sentiment you see with BC alumni—that sense of camaraderie and care for fellow Eagles.”

.jpg)

SSC general parters with participants of the accelorator program.

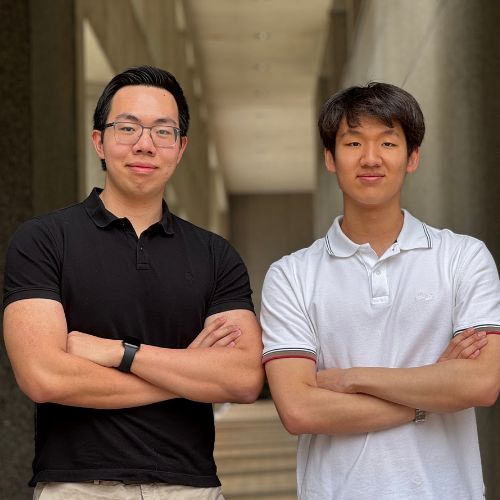

Ted Wind ’25 and Dan Biundo, MCAS ’25, participated in the summer accelerator program after sophomore year for their business Socion, a software platform in the influencer marketing space. “We entered the accelerator in a kind of fog,” Wind recalls. “Where should we go with the business? Where do we start? But right from the beginning, we had help.” They tapped into SSC’s robust mentoring network, and this year, the two juniors landed their first customers. The business continues to grow.

Through SSC, alumni and other investors have made 109 investments in Boston College startups to the tune of more than $5 million altogether. Forty-three percent of those startups had diverse founders, who are otherwise “woefully underrepresented in the venture capital industry,” Quinn says, noting that less than 2 percent of all venture capital goes to women and minorities. But she adds that SSC has been intentional about "welcoming and nuturing diverse founders."

.jpg)

SSC’s general partners Christina Quinn ’13, Tom Coburn ’13, and Duncan Walker ’13 (not pictured: Peter Bell '86, P '20, '25).

One of them, Lurein Perera, MCAS ’21, went from the Shea Center’s spring accelerator to SSC’s summer accelerator. After those experiences, he came up with the idea for GiveCard, which provides a cash-transfer solution with no fees for the end user. Perera drew a six-figure investment in GiveCard from SSC two years ago and was introduced to other investors who added to the pot. “Tens of thousands of people in the US are using GiveCard today,” says Perera. “They’re getting meals, hotel stays, and paying for education. To have had that kind of impact is really cool.”

SSC provides $10,000 in funding to each accelerator startup, and the successful businesses that have emerged from the program “are as diverse as its founders,” says Duncan Walker ’13, CTO of music marketing firm Heard (which went through the accelerator) and an SSC GP. He points to companies ranging from Viv, which makes sustainable period care products, and Kured, a charcuterie board company with stores in New York and Boston, to Fisherman, which produces restaurant websites.

All of this fits seamlessly into Boston College’s entrepreneurial ecosystem, says Jere Doyle, the Popolo Family Executive Director of the Shea Center, explaining that many of Shea’s speakers, mentors, and competition judges come from SSC. “It’s natural for a Shea student to look to SSC when it’s time to take next steps.”

The team invites anyone interested in SSC to contact partners@sscventurepartners.com.